The financial services industry is crucial to everyone, but I feel it is undeserving its clients in general due to a lack of innovation.

When we look at how companies have innovated and blurred the lines in and between industries to create services that customers want, such as Netflix in the media industry with its streaming services and Amazon under the guise of retail, it’s clear that consumers want new and innovative ways of doing things.

Existing financial institutions are concerned about the constraints of their fundamental architecture platforms. The availability of new tools makes the task less onerous.

The banking industry is becoming more competitive. Neo-banks are gaining market share and providing services to customers at around one-third the cost of regular banks.

Fintechs are focusing on profitable value chain areas. With their vast client bases, big tech competitors offer a significant danger, and a few incumbents are spending extensively in innovation, leaving laggards in the shade.

Attackers are expanding their businesses and attracting customers by leveraging current core technology architecture, which allows them to innovate more quickly and run more efficiently.

Not surprisingly, incumbent banks are growing increasingly concerned about the constraints of their own core infrastructures and the glacial pace of change. As a result, according to a McKinsey poll of 37 banking executives conducted in May 2019, 70% of banks are assessing their core banking platforms.

Legacy Technology Keeps Stifling Next-generation Core Banking

One of the primary reasons for the lack of innovation in financial services is that the underlying technology does not permit it.

Inflexible traditional core banking systems However, we are seeing new FinTech challengers gain substantial traction in client acceptance because they can innovate and are not constrained by legacy systems.

Traditional banks’ basic banking systems were often implemented decades ago. They’ve become a jumble of technologies that hinder innovation over time.

Banks’ ability to bring true new offerings to market is hampered by both complicated technology and high costs. As a result, consumers do not receive the quality of service or services that they would expect from a financial institution.

Banks have generally been stranded in a technical backwater. They can solve the marooned technology environment with BX and application modernization.

Next-generation Core Banking Needs The Cloud Treatment

Kilowott enables banks to catch up with the industry’s adversaries and achieve the type of change that other industries have seen in previously unimaginable ways. We are focused on designing and developing cloud-native core banking engines with renewal in mind, deep within the banks.

Kilowott provides cloud solutions using next-generation cloud-native technology, cloud professionals, and strong links with the global banking community.

Most banks have already begun some sort of digital transformation, but much of it has been from the top down or from the outside in. They have digital channel access via apps and online banking, as well as numerous processes within the bank or at branch networks.

However, they have not fully digitized the entire vertical stack. Because of Kilowott’s excellence and skill in operational understanding of a bank’s whole stack, as well as what our technology brings to the table, banks can finally achieve full renewal and digital transformation in the cloud.

Cloud-native is Different From Cloud-based

Today’s forward-thinking banks are aware that the migration to the cloud will result in significant cost savings and enhanced client offers. Bank of England Governor Mark Carney noted a 30 to 50 percent cost savings for banks moving their applications to the cloud in a recent address.

A truly cloud-native, next-generation core banking system and just transferring legacy technologies to the cloud are very different from one another in terms of efficiency.

Systems must be created and birthed in the cloud for them to be considered genuinely cloud native. By that, I mean that they have a true micro-service architecture, are containerized, are deployed using Kubernetes, and have a full range of RESTful APIs for all of their external access points.

How are legacy platforms inhibiting performance?

1. Due to the low industry return on equity, cost is more crucial than ever (ROE). A mid-sized bank spent two-thirds of its digitalization budget on technical debt in older systems, which consumes significant amounts of IT spending.

Unnecessarily high expenses are caused by clunky legacy systems, manual software delivery (manual regression testing and deployment), and low straight-through processing rates (accumulated layers of complexity resulting in fragmented and manual operational procedures).

2. In the current saturated market, being able to introduce items fast is a crucial competitive differentiator. Monolithic architectures, which create numerous interdependencies and bottlenecks, poorly documented legacy code, which places an undue burden on a small number of subject matter experts, and manual delivery procedures, on the other hand, impede the delivery of products more quickly.

3. Customers now demand a more customized experience. However, banks frequently store data in numerous product-aligned core systems, which makes it difficult to respond to specific demands. To give one big bank’s customers a combined view of savings accounts and investment products, the firm had to invest heavily in a two-year effort.

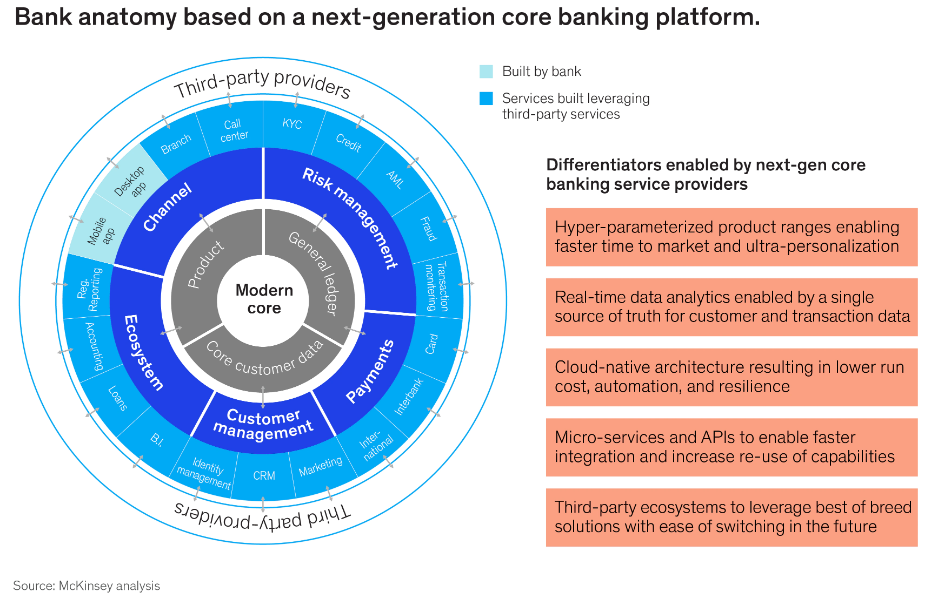

4. Future products and services will increasingly depend on partnerships. However, present systems lack the third-party connectivity needed to foster innovation (e.g., property related services for mortgage buyers).

The tools are available to address these difficulties, which is good news for the incumbents. A new generation of cloud-native core banking platforms is in particular emerging.

How can next-generation core banking benefit banks?

1. Banks can reduce spending by increasing developer output and paying off technical debt. By utilizing cloud-based services (which allow businesses to swiftly deploy new products and scale infrastructure) and development tools that facilitate automation, they may increase efficiency even more (DevSecOps).

2. Hyper-parameterized configuration capabilities help banks create new products and services more quickly and easily. It is easier to use contemporary techniques, like automated testing, at higher degrees of standardization, which enables the implementation of more frequent release cycles.

3. The ability to use data is expected to become a key distinction. Integrated data sets and a single source of truth are supported by modern platforms.

These in turn enable real-time personalization of experiences and the use of advanced analytics for more informed decision-making (e.g., for front-line staff).

4. Rapid scaling and less expensive creation of ecosystems and associated services are made possible by new platforms. Modular structures and API communication make integration simpler.

It’s hardly surprising, given these advantages, that more than 65% of the banks in our poll are investigating the potential of next-generation platforms. In fact, many organizations have announced agreements and are on their way to achieving important benefits.

For many years, the core of bank operations has been its core banking systems. However, many of these legacy platforms are now finding it difficult to stay up as the financial industry changes more quickly than ever as a result of new digital advances, regulations, and consumer expectations.

The outcome?

Banks are discovering more and more that their current cores are preventing them from providing the experiences that clients currently need, primarily because of restrictions related to:

Complexity – Mergers and divestitures have produced core banking infrastructures that are intricate and suboptimal, and fresh regulatory requirements have only increased this complexity.

Flexibility – Originally designed with durability in mind, core banking systems are now locked on outdated mainframe architectures and depend on shrinking talent pools, resulting in tech stacks that are frequently prohibitively slow and expensive to update.

Capability – Adapting customer expectations are straining legacy cores beyond their breaking point. Many are unable to match contemporary expectations in terms of instantaneous transaction alerts, in-depth understanding of spending patterns, and quick product development. Customers are correct to wonder why traditional banks are unable to provide the same level of service as online challengers.

Bank operations leaders concur that reform is urgently needed in light of these difficulties.

According to Accenture’s North American Banking Operations Survey, 80% of bank executives fear that their company’s survival may be in jeopardy if they do not upgrade their technology to be more adaptable and able to support rapid innovation.

By making short-term incremental improvements on legacy platforms, or “hollowing out the core,” some banks have tried to close the innovation gap, buying themselves some time as the market innovates.

Cloud-native core banking, however, has recently become a new front-runner in the fight to discover a more long-lasting solution.

Many of the issues I’ve outlined above are addressed by this strategy, which gives banks a highly scalable API-led core that is quick enough to let them compete with new challenger banks.

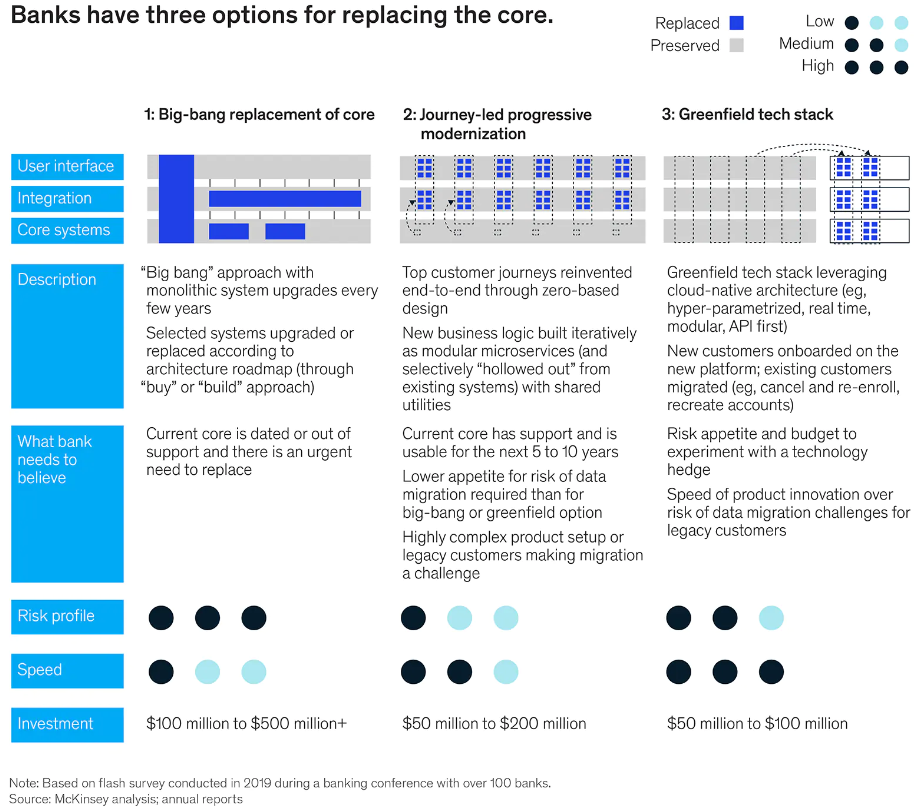

Replacement of the entire tech stack, starting with the core. When companies urgently need to change their fundamental platforms due to obsolescence or regulatory requirements, banks frequently take this course of action.

However, it might be dangerous. The advantages usually only become apparent after the last client has been converted and the legacy systems have been terminated, which necessitates considerable data migration.

Banks typically opt for a traditional platform as a replacement due to worries that next-generation platforms have not yet been completely tested or are just focused on a narrow range of services and goods.

The majority of banks have used this tactic. It entails keeping the legacy platform while gradually reducing it as a modern architecture is built over it. If the current architecture is still functional in five to ten years, it is frequently regarded as a safe choice.

The most cutting-edge banks begin by hollowing out commonly used capabilities and reconstructing them as microservices, using a “strangler pattern” to start with the most important client journeys. Although the technique is less risky than the first option, banks may not reach the desired levels of efficiency and time-to-market due to slow transition durations.

Given that many banks are investigating next-generation core platforms, this option might be the most advantageous.

A few institutions are also considering the possibility of transferring a significant incumbent customer base through a “reverse takeover” technique.

The market is on the verge of an inflection moment, at which technology leaders will distance themselves from the competitors by a wide margin. The final word? CXOs must have a defined plan if they want to stay competitive.