After COVID, there have been significant changes in how consumers pay, including a further move toward a cashless society and a digital upheaval in e-commerce payments.

Looking ahead, we observe these tendencies intensifying and the emergence of new payment rails.

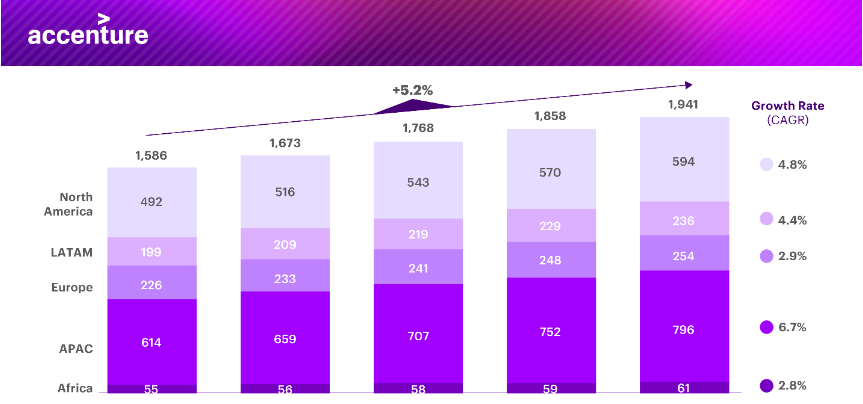

Compared to the global average of 5.2%, Accenture’s predictions for the Global Payments Revenue indicate that APAC will experience the highest payment growth, at 6.7% year over year.

This is expected as APAC pushes toward cashless transactions, but the nations in the area are also advancing technologies that the rest of the globe has not yet embraced.

For instance, WeChat and AliPay have experienced explosive growth in digitally developed markets by combining social media, marketplaces, and financial services.

In all marketplaces, competition from new and creative payment players is increasing. Due to the departure of some of the conventional payments customers, banks are feeling the heat from the scale-ups in payments.

According to an Accenture study, UK banks have been beaten by digital firms like PayPal and Square in terms of total return to shareholders (TRS) by an astonishing 12 times since 2016.

Comparatively, over the same time period, payment processors like Visa and Mastercard generated 2.6 times the TRS of UK banks.

The dominance of cards is being seriously challenged by quicker payments rails, putting even the processor business model in jeopardy.

It is difficult to forecast the state of the payments industry. Account-to-account transfers will replace conventional card rails?

Will the function of payment intermediaries be replaced by central bank digital currencies (CBDCs)?

What new applications will this provide retailers access to?

Only time will tell how far these technologies advance, but simply put, if payment providers don’t innovate, new global fintechs will, thus the cost of delay is sure to rise.

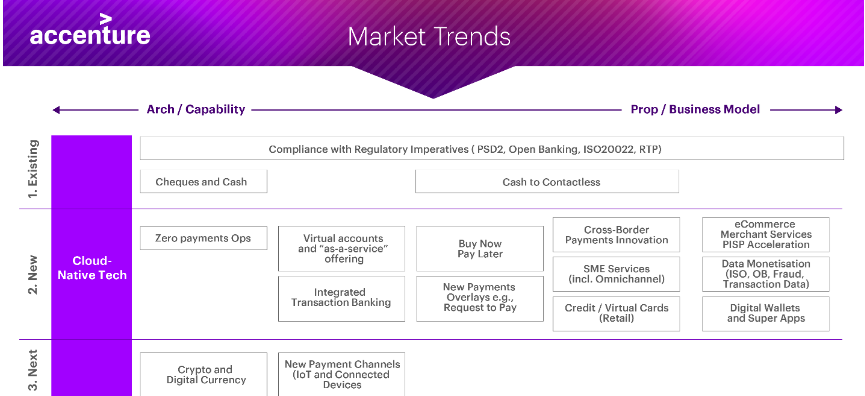

The three waves of relevant payment disruption are “existing,” “new,” and “next.” While we’re about to examine each of them more closely, it’s crucial to keep in mind that these phases cannot be seen separately.

For instance, there won’t be a license to operate when dealing with new value levers if payment providers don’t handle existing regulatory imperatives. Similar to this, payment providers won’t have a place at the table to test out new use cases that enable the next wave of development if client acquisition is not enhanced through payments innovations that answer customer wants.

1. Future of Payments Back Then

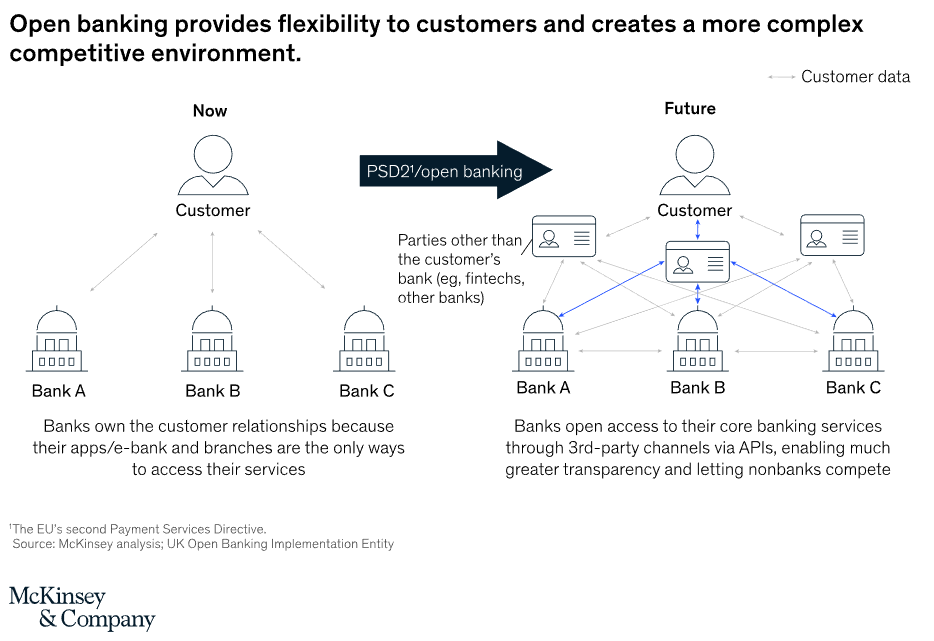

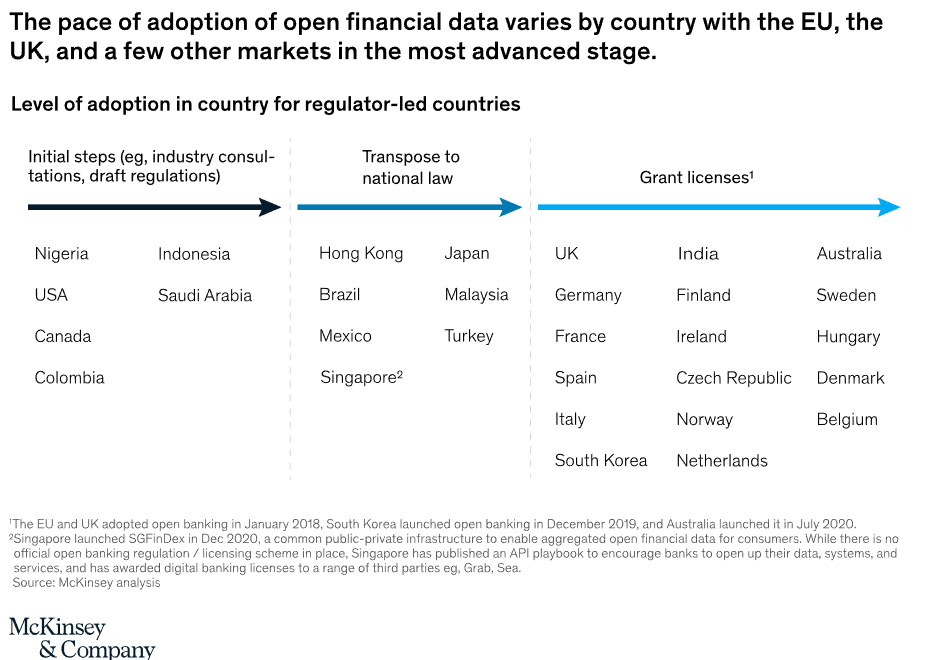

PSD2 has been in place in Europe for more than two years. In that time, user experiences have advanced, and some of the key businesses have committed millions to address the new pain points.

Even if Open Banking has grown in scope, payments still make up a small portion of the overall volumes.

For instance, only two million of the 840 million successful API requests made in July of this year in the UK utilizing open banking were for payments. Less than 0.5%, in total.

We anticipate that payments will increase as a percentage of this total over the coming years, driven by more integrated payments.

Customers expect payments to be integrated into a smooth end-to-end experience rather than being a separate step or afterthought.

Meanwhile, retailers want to enable smooth checkout, request payment, and offer financing such as buy now pay later (BNPL) to clients, all in one location.

PayPal, Revolut, and other companies are introducing “super applications” for consumers that include payments, savings, bill payment, cryptocurrencies, shopping, and more.

Open Banking payments will become more viable if you consider the entire client experience. The most recent to do so is Klarna, which unveiled an in-app online store to support its transition from a BNPL payments provider to a hub for shopping and loyalty.

This necessitates a fundamental shift in the way banks now handle ecosystem plays. In the past, banks have created new apps in separate technological environments, leaving a dispersed selection of various services.

One example is the “Simple” personal finance app from BBVA, which was discontinued in May.

This service unbundling is coming to an end as banks, fintechs, and e-commerce firms must collaborate in a single ecosystem supported by a common technological stack.

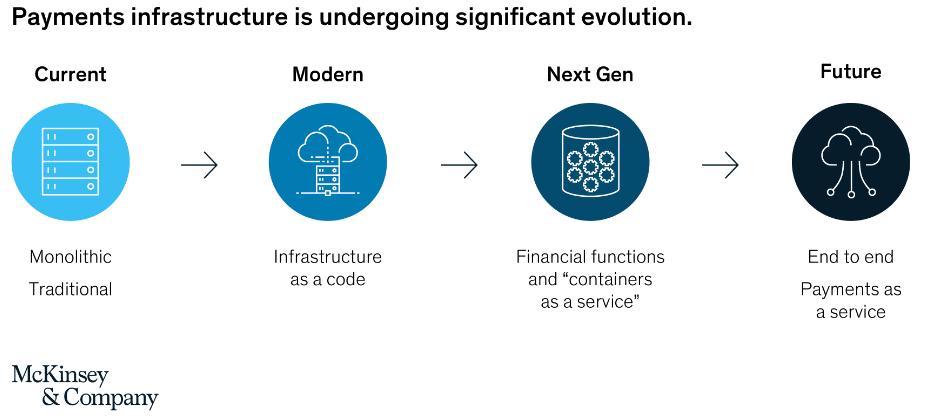

Payment service providers are currently adjusting to regulatory requirements like ISO 20022, an upcoming worldwide payment standard.

By 2023, it is anticipated that ISO 20022 would be used in about 90% of financial transactions worldwide.

The standard’s widespread implementation could have a positive impact on the financial system by enhancing the data contained in payments messages, enhancing platform compatibility, and opening doors for collaboration and innovation.

A more adaptable and responsive payments architecture is required to meet regulatory requirements as well as changing consumer behavior, such as the switch from cash to contactless payments.

To support the above-mentioned new use cases, nimbleness will make it possible to switch to a shared set of payment processor microservices, cloud-based infrastructure, and a better data approach.

2. Future of Payments Now

Numerous tendencies that were already in motion before to COVID’s breakout have been accelerated.

In the e-commerce business, which Statista projects will increase at a 6% annual rate between 2021 and 2025 and reach $4.2 trillion at the end of that time, cards and digital wallets stand out as the clear winners.

Account-to-account (A2A) transfers, which make up about 13% of checkouts in Europe, and BNPL have both experienced explosive growth over the past year.

For incumbents who rely on the conventional four-party paradigm and profit from markups on interchange fees and merchant service fees, this has significant strategic ramifications.

Banks and payments businesses must review their go-to-market strategies and payment mix because these fees are in danger. It will become more important to handle legacy cost bases as businesses go through this transition.

Operations in the back office are hampered by excessive expenses, poor efficiency, and aging infrastructure.

Automating manual back-office tasks with zero-based operations can result in lower costs and better customer experiences. Efficiency increases of up to 50% are rather common.

In addition to developments aimed at consumers, B2B services have also greatly expanded.

Smaller businesses in the payments industry are multiplying, and many of them are looking for as-a-service alternatives because they might not have the resources to design or operate their own systems effectively.

Current payment providers may elect to make their updated cores and payment architectures available to other parties in order to create new revenue streams.

3. Future of Payments Next

As payments become more integrated into markets and across industry use cases, lines between banks, fintech players, and big tech will blur in the future. Consumers’ other internet-connected devices are opening up new markets for commerce beyond smartphones.

Any item a consumer wears, such as watches, bracelets, and rings, has the potential to function as a contactless payment device.

IoT payments currently total $5.76 billion, and by 2024, it is predicted to reach $7.56 billion, according to research by Mercator Advisory Group.

In order to safeguard consumers and maintain payment sovereignty, regulators and central banks will collaborate more closely with large tech and payment leaders.

This is particularly true for CBDCs, which are gaining ground. In April 2021, the Bank of England and HM Treasury announced the formation of a joint task team to research the viability of such a currency.

A CBDC Technology Forum, whose members are drawn from financial institutions, academic institutions, fintech companies, infrastructure providers, and technology corporations, is supporting this and offering advice on all facets of CBDCs.

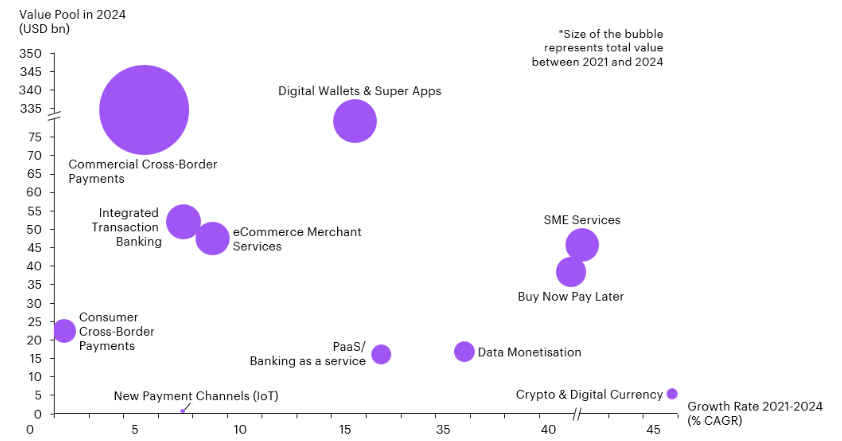

We forecast that, by 2024, the revenue pools with established use cases and established marketplaces will be the greatest.

Data monetisation, BNPL, SME services, and digital currencies are some of the smaller revenue streams that are expanding extremely quickly.

These revenue streams are not mutually exclusive, and by combining several value levers, the value indicated above might really increase.

Payments will, as previously stated, become more thoroughly integrated into broader financial offers and consumer journeys. Those who find a solution for this fully integrated payments experience will come out on top.

Considerations for Future of Payments

Each payment provider should take into account these five steps to seize the development prospects we’ve covered:

To succeed, identify the most pertinent financial use cases. Consider the demands of the consumer from beginning to end and pinpoint areas where payments might be integrated rather than kept apart from other financing options.

Clearly state your primary competencies and your marketing strategy. Consider whether it makes more sense to participate in a larger ecosystem or to offer your platform as a service to other payment providers.

Engage the ecosystem, from exploring collaboration with partners across the value chain to opening APIs with fintechs that bring together various offers to provide a single seamless customer experience.

To improve speed and nimbleness, conduct a complete technical review on how to use microservices and a cloud-based architecture.

To finance new investments, change operating models and automate the entire process, including zero-based payment operations and the shutdown of legacy platforms.

We empower companies from across the banking, fintech, and NBC sector, to offer everything from real-time transformation of banking operations to applications that can bolster monetary transactions..

Need help? Let’s talk